-

EEUU

US Tariffs | Commercial risk management in contracts with international clients and suppliers

14 abril 2025

- Contratos de distribución

- Derecho Fiscal y Tributario

The most dangerous mistake one can make after the announcement of the (partial) suspension of U.S. duties for 90 days is to hope that everything will go well and we will return to the pre-April 2 world.

First, because very invasive tariffs remain in place: 10 percent on all countries that trade with the U.S., including the EU, 25 percent on automotive, 25 percent on steel and aluminum, 145 percent on China.

Second, because it is impossible to predict the actions of the U.S. Administration in the short and medium term: it cannot be ruled out that tariffs will remain, increase, change targets or that other factors will intervene to turn the tide in international markets, such as an escalation of the trade war with China.

The 90-day suspension is an opportunity

The U.S.’s temporary suspension of tariffs represents a valuable window that should be used not only as a truce but also as a valuable room for action: 90 days to rehash contracts, renegotiate key clauses, and insert levers of flexibility that can protect business in various future scenarios in the U.S. and other markets.

Today’s exporters cannot afford to «sit back and see what will happen»-it is time to act, and to do so professionally and strategically. Let’s look at a checklist of important points to consider.

What do contracts with customers and suppliers entail?

The first point is to survey agreements with the trade network in the U.S. and other countries that export to the U.S., as well as with upstream suppliers in the supply chain.

Is there a written contract? The worst-case scenario – unfortunately a very frequent one – is when the parties cooperate informally, only based on orders and order confirmations. This leaves undefined not only what happens in the case of imposition of duties, but also a whole range of other points, for example, limits on damages that can be claimed in the case of breach of contract, the duration of the agreement, the applicable law, and how any disputes will be resolved.

Another very problematic scenario is one in which contracts exist, but they are generic and do not include the necessary covenants to manage the risks involved in operating in a highly litigious market such as the U.S., which, moreover, has very high legal costs.

Having done this analysis, the necessary actions can be put in place, prioritizing according to the importance of business relationships and as appropriate:

- Negotiate and conclude a written contract from scratch

- Replace the existing agreement with a complete and correct contract

- Amend and integrate the existing agreement with pacts to manage tariffs and other causes of price fluctuations

Let us dwell on the last scenario, assuming that there is a complete and correct contract but one that does not regulate price and cost fluctuation as a direct or indirect consequence of the introduction of duties.

Contract Addendum

In such cases, the correct course of action is to sign an Addendum to the original contract, specifying which covenants are being waived and which covenants are being added. It is essential that the Addendum be negotiated and signed by persons with the power of representation of the parties and that it be drafted with the help of lawyers who specialize in this field. In addition to including correct clauses, it is necessary to verify that the covenants are valid according to the rules of law applicable to the contract.

Here are some clauses that can be the subject of the Addendum, to be modulated according to the specific case and possible scenarios.

Tariff Cost Sharing

By introducing this covenant, it is provided that in the event that duties are confirmed at [x]% or are reduced or increased within certain established thresholds, the Parties will share the increase equally, or according to other established percentages.

There may also be a ceiling on tariffs beyond which a party has the right to withdraw from the contract or request the suspension of certain orders for a specified period of time, after which it has the right to withdraw.

Price Adjustment

With this covenant, a discount or an increase in the product’s price is agreed upon, as the case may be, in the case of a duty greater than [x]%.

Among the use cases, in addition to that of the company exporting to the U.S. or other intermediate markets, with final destination of the products in the U.S., is that of those who purchase a product subject to import duty and resell it, processed or assembled.

Right to Cancel or Postpone Confirmed Orders

This covenant gives the right to revoke or suspend for a certain period already negotiated orders, as such binding, in case of confirmation or introduction of duties above a certain threshold, for example, if 20% taxation was confirmed for the import of wine from the EU.

The clause can be combined with previous covenants, for example, by stipulating that below the specified threshold, the contracts remain valid, and the parties share the duty or have the right to renegotiate the price.

Supply Forecast Adjustment

With this clause the Parties can modify supply programs already agreed for a specific duration (e.g., 24 months), with continuous sales and purchase obligations at a fixed price or indexable only within certain limits. The aim is to agree on the prerequisites for reshaping supply programs in the short and medium term, which can be very useful for defining the rules that will apply to relationships with key suppliers or customers for possible changes in volumes, delivery times, and prices.

Right to Source from Alternative Suppliers

This covenant serves to be authorized, if necessary, to source alternative suppliers of components or raw materials to those previously authorized in the contract with the end customer, for example, in cases where purchasing from the original suppliers has become too costly or difficult due to duties imposed at import or in previous steps in the supply chain, or other events such as currency or price fluctuation of certain commodities beyond a certain level established in the agreement.

Hardship and Force Majeure

The imposition of duties cannot be invoked as a cause of Force Majeure or hardship, respectively, to excuse contract non-performance or to renegotiate the price, even in cases of very high price increases (such as the 145% duty imposed on Chinese products). This conclusion is almost uniform under the law and jurisprudence of the major countries involved in the tariff war: U.S., China, Canada, Mexico, France and Italy: I refer to this practical guide for a timely examination of what the various rules provide.

If the contract lacks a well drafter Force Majeure and Hardship clause, or contains a generic clause, it is important to get your hands on revising it to expressly state the cases in which a party is entitled to suspend or terminate the contract, how and when to communicate the decision to invoke the exemption, and the consequences on the parties’ contractual obligations. You can go deeper on this topic here.

Conclusion

It is essential to prepare for possible future scenarios regarding duties (confirmed, increased, changed, or decreased) and to determine the consequences on trade relations with foreign clients and suppliers: moving today, at a standstill (or nearly so), allows entrepreneurs to negotiate shared and fair solutions and to avoid, as far as possible, the emergence of tensions and conflicts with the various partners along the international supply chain.

The case: A consumer bought a Ford car in Italy from an Italian car distributor. The car was manufactured by Ford WAG in Germany and supplied by Ford Italia, which belong to the same group of companies. Following an accident in December 2001 in which the airbag failed, the consumer sued the Italian distributor as well as Ford Italia for damages. Ford Italia disputed the claims for damages asserted against it, arguing that it had not manufactured the vehicle and, because it was itself only a distributor/supplier, referred to Ford WAG in Germany as the actual manufacturer.

Question to the European Court of Justice (ECJ)

The Italian Supreme Court (Corte di Cassazione) referred the following question to the ECJ:

- the manufacturer’s liability under the Product Liability Directive 85/374/EEC is limited in accordance with Art 3 to cases where the supplier physically puts his name, trade mark, or other distinguishing feature on the product to create confusion between his identity and that of the actual manufacturer;

- or is the distributor liable as a “quasi-producer” even if he has not physically put his name or trademark on the product, but nevertheless «presents himself as its producer» within the meaning of Article 3(1) of the Directive by using the distinguishing feature in his company name, which was put on the car by another person, but leading to identity with the actual car manufacturer.

ECJ judgement (European Court of Justice) of 19/12/2024, Case C-157/23

A company that does not manufacture a product itself, but only distributes it, can still be considered a «manufacturer» within the meaning of the Product Liability Directive (85/374/EEC). This is the case if the distributor puts his name, trademark or other distinguishing feature on the product and consequently presents itself as the manufacturer. According to the ECJ, this can give the consumer the impression that the distributor is responsible for the quality and safety of the product.

However, the ECJ emphasizes that liability does not depend on whether the distributor puts the sign on the product itself. The distributor did not do so in the specific case. However, the distributor used the corresponding distinguishing feature in its company name. According to the ECJ, the decisive factor is, therefore, whether the distributor uses this name match to gain the trust of consumers and is thus perceived as a responsible manufacturer.

The distributor is jointly and severally liable with the actual manufacturer. This means that consumers can either make a claim against the manufacturer or the dealer directly. However, the dealer has the right to ask for a regress for the damage incurred from the actual manufacturer.

Remarks

The ECJ emphasizes consumer protection. In my opinion, this argument is slightly overstretched:

- According to the ECJ, the consumer should not be burdened with the complex task of identifying the actual manufacturer of a defective product.

- A distributor that sells a product and uses its name or trademark to do so creates trust in the consumer. This trust is to be protected by the liability of the authorized distributor – regardless of whether the distributor has actively put its trademark on the product or not.

- This increases the liability risk for authorized car dealers because they must obtain appropriate insurance against such a risk. In the constellation described above, authorized dealers can be exposed to unexpectedly high claims for damages under strict product liability.

Good advice is not expensive

- It is essential that such cases are legally clarified when drawing up and formulating distribution agreements with car manufacturers and that the ECJ ruling is considered.

- In addition, authorized dealers/distributors should reconsider the use of product names from the actual producer in their company name and/or in their corporate image.

The Brazilian market has not been immune to the protectionist wave of «America First.» If such measures persist over time, they could have a lasting impact on the local economy. Still, a sour lemon can often become a sweet caipirinha in the resilient and optimistic spirit that characterizes both Brazilian society and its entrepreneurs.

As is often the case in the chessboard of global economic geopolitics, a move from one player creates room for another countermove. Brazil reacted with reciprocal trade measures, signaling clearly that it would not accept a position of commercial vulnerability.

This firmer stance — almost unthinkable in earlier years — strengthened Brazil’s image in Europe as a country ready to reposition itself with greater autonomy and pragmatism, opening new doors to international markets. In a world where global value chains are being restructured and reliable trade partners are in high demand, Brazil is increasingly seen not just as a supplier of raw materials, but as a strategic partner in critical industries.

The rapprochement with Europe has been further energized by progress in the Mercosur–European Union Agreement, whose negotiations spanned decades and now seem to be gaining momentum. While the United States embraces a more isolationist commercial posture, Europe is actively diversifying its trade relations — and Brazil, by demonstrating a commitment to clear rules, economic stability, and legal certainty, emerges as a natural candidate to fill that gap.

The Direct Impact of U.S. Tariffs

The trade measures introduced under President Trump primarily affected Brazilian producers of semi-finished steel and primary aluminum, with the removal of long-standing exemptions and quotas. In 2024, Brazil exported US$ 2.2 billion in semi-finished steel to the United States, representing nearly 60% of U.S. imports in that category. In the same year, Brazilian aluminum exports to the U.S. reached US$ 796 million, accounting for 14% of the sector’s total. Losses in exports for 2025 are estimated at around US$ 1.5 billion.

Brazil’s Response and a New Phase

In April 2025, the Brazilian Congress passed a new legal framework for trade retaliation, empowering the Executive Branch to adopt countermeasures in a faster and more technically structured way. The new legislation allows, for example, the automatic imposition of retaliatory tariffs on goods from countries that adopt unilateral measures incompatible with WTO norms; the suspension of tax or customs benefits previously granted under bilateral agreements; the creation of a list of priority sectors for trade defense and diversification of export markets.

Beyond the retaliation itself, the move marked a significant shift in posture: Brazil began positioning itself as an active player in global trade governance, aligning with mid-sized economies that advocate for predictable, balanced, and rules-based trade relations.

An Opportunity for Brazil–Europe Relations

This new stage sets Brazil as a reliable supplier to European industry — not only of raw materials but also of higher-value-added goods, particularly in processed foods, bioenergy, critical minerals, pharmaceuticals, and infrastructure.

Moreover, as US–China tensions drive European companies to seek nearshoring or “friend-shoring” strategies with more predictable partners, Brazil, with its clean energy matrix, large domestic market, and relatively stable institutions, emerges as a strong alternative.

Legal Implications and Strategic Recommendations

This changing landscape brings new opportunities for companies and legal advisors involved in Brazil–Europe investment and trade relations. Particular attention should be paid to:

- Monitoring rules of origin in the Mercosur–EU agreement, especially in sectors requiring supply chain restructuring;

- Reviewing contractual and tax structures for import/export operations, including clauses addressing tariff instability or non-tariff barriers (e.g., environmental or sanitary standards), and clearly defining force majeure events;

- Reassessing distribution and agency agreements in light of the new commercial environment;

- Exploring joint ventures and technology transfer arrangements with Brazilian partners, particularly in bioeconomy, green hydrogen, and mineral processing.

From lemon to caipirinha

The world is becoming more fragmented and competitive, but also more open to realignment. What began as a protectionist blow from the United States has revealed new opportunities for transatlantic cooperation. For Brazil, Europe is no longer just a client: it is poised to become a long-term strategic partner. It is now up to lawyers and businesses on both sides of the Atlantic to turn this opportunity into lasting, mutually beneficial relationships.

On April 2, 2025, U.S. tariffs toward products from the EU will go into effect.

Given what happened with the tariffs imposed on Canada and Mexico, with a chase of announcements of entry into force and suspensions and new announcements, it is impossible to make even short-term predictions.

One must prepare oneself for the possibility of imposition of duty, which is a foreseeable and anticipated event and, as such, should be regulated in the contract. Failure to do so is likely to be very costly because there are no valid arguments for excusing the non-performance of contracts already concluded by invoking a situation of Force Majeure (which does not exist, because the performance has not become objectively impossible) or of supervening excessive onerousness or hardship: even in the case of increases well over 25 percent, tribunals around the world tend to rule out its invocation).

The caution that can be taken is to negotiate a price update clause, expressly referring, among other factors, to the eventual adoption of tariffs.

A useful clause may be the so-called Escalator or Price Adjustment Clause, by which the right to renegotiate the price is provided in the case of imposing a duty above a certain threshold, for example:

PRICE ADJUSTMENT CLAUSE

Triggering Event

A «Triggering Event» shall be deemed to occur if:

- There is an increase in customs duties or the introduction of new trade barriers not previously contemplated, resulting in an increase in the total price of the goods or services by X% or more.

- Such an increase affects either (i) the Buyer directly or (ii) the Seller due to tariffs imposed on its upstream suppliers, materially impacting the cost of performance.

Trigger Mechanism

In the event of a Triggering Event:

- The affected Party shall notify the other Party in writing within thirty (30) days of the effective date of the customs duty change or the introduction of the new trade barrier.

- The notification must include supporting documentation demonstrating the financial impact of the Triggering Event.

Renegotiation Process

Upon receipt of a valid notification, the Parties shall engage in good-faith negotiations for sixty (60) days to agree on an adjusted price that reflects the increased costs.

Failure to Reach an Agreement

If the Parties fail to reach an agreement on the price adjustment within the prescribed sixty (60) days:

Option 1 – Contract Termination: Either Party shall have the right to terminate the contract by providing written notice to the other Party, without liability for damages, except for obligations already accrued up to the termination date.

Option 2 – Third-Party Arbitrator: The Parties shall appoint an independent third-party arbitrator with expertise in international trade and pricing. The arbitrator shall determine a fair market price, which shall be binding on both Parties. The cost of the arbitrator shall be borne equally by both Parties unless otherwise agreed.

***

Another possible tool as an alternative to the clause just seen is the so-called Cost Sharing clause, for example:

COST SHARING CLAUSE

Triggering Event

A «Triggering Event» shall be deemed to occur if there is an increase in customs duties or the introduction of new trade barriers not previously contemplated, resulting in an increase in the total price of the goods by [X]% or more. Such an increase will be borne by the Buyer by up to [X]%, while higher increases will be shared equally between the seller and buyer.

***

It is appropriate for such clauses to be adapted on a case-by-case basis to best to reflect the scenarios that are expected to affect the price of the products, namely

- imposition of duty on U.S. entry

- imposition of duty on EU entry

but also indirect effects, such as where it is the seller who invokes price renegotiation, for example because the price of the product has increased due to the duty paid by one of its upstream suppliers in the supply chain, in which case it is crucial to identify which products are relevant and to document the increases resulting from the imposition of tariffs.

Duties are not paid by foreign governments (as Donald Trump repeatedly said on the electoral campaign) but by the importing companies of the country that issued the tax on the value of the imported product, i.e., in the case of the Trump administration’s recent round of tariffs, U.S. companies. Similarly, Canadian, Mexican, Chinese, and – probably – European companies will pay the import duties on U.S.-origin products levied by their respective countries as a trade retaliation measure against U.S. tariffs.

In this context, several scenarios open up, all of them problematic

- U.S. companies will pay the import taxes

- foreign companies exporting taxed products to the U.S., will see export volumes fall as a result of the price increase

- foreign companies that import products from the U.S., in turn, will pay tariffs imposed by their countries in retaliation to U.S. duties

- intermediate or end customers in markets affected by the tariffs will pay a higher price for imported products

Does the imposition of the duty constitute force majeure?

A frequent first objection of the party affected by the duty (it may be the buyer-importer or the one who resells the product after paying the duty), in such cases, is to invoke force majeure to evade the performance of the contract, which, as a result of the duty has become too onerous.

The application of the duty, however, does not fall under force majeure since we are not faced with an unforeseeable event, resulting in the objective impossibility of fulfilling the contract. The buyer/importer, in fact, can always fulfill the contract, with only the issue of price increase.

Does the imposition of the duty constitute a cause of hardship?

If a situation of excessive onerousness arises after the conclusion of the contract (hardship), the affected party has the right to demand a revision of the price or to terminate the contract.

Is this the case for tariffs? A case-by-case assessment is needed, leading to a finding of recurrence of hardship if an extraordinary and unforeseeable situation exists (in the case of the U.S. duties, which have been announced for months, it isn’t easy to support this) and the price, as a result of the application of the tariff, is manifestly excessive.

These are exceptional situations, rarely applied, and should be investigated further based on the law applicable to the contract. Generally, price fluctuations in international markets are part of business risk and do not constitute sufficient grounds for renegotiating concluded agreements, which remain binding unless the parties have included a hardship clause (discussed below).

Does the application of the tariff entail a right to renegotiate prices?

Contracts already concluded, such as orders already accepted and supply schedules with agreed prices for a certain period, are binding and must be fulfilled according to the original agreements.

In the absence of specific clauses in the contract, the party affected by the tariff is therefore obliged to comply with the previously agreed price and give fulfillment to the agreement.

The parties are free to renegotiate future contracts, e.g.

- the seller may give a discount to lessen the impact of the duty affecting the buyer-importer, or

- the buyer may agree to a price increase to compensate for a duty that the seller has paid to import a component or semi-finished product into his country, and then export the finished product

but this does not affect the validity of contracts already negotatied, which remain binding.

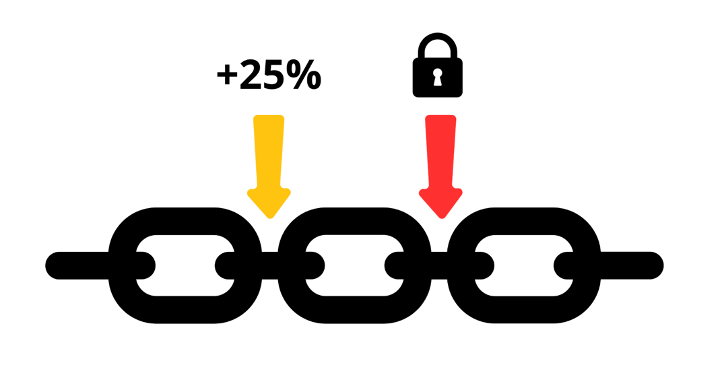

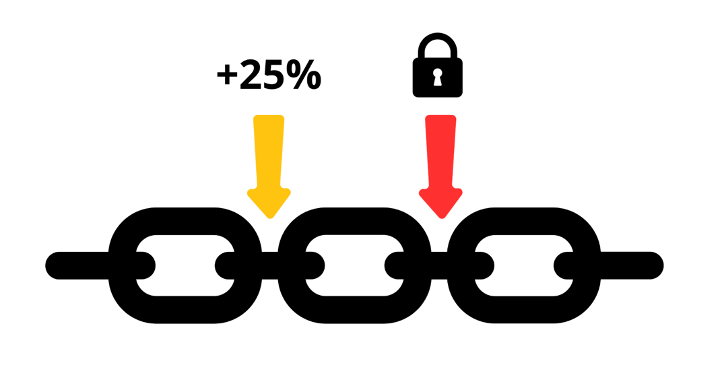

The situation is particularly delicate for companies in the middle of the supply chain, such as those who import raw materials or components from abroad (potentially subject to tariffs, including double duties in the case of repeated import and export) and resell the semi-finished or finished products, since they are not entitled to pass the cost on to the following link in the supply chain, unless this was expressly provided for in the contract with the customer.

What can be done in case of imposition of future duties affecting foreign suppliers or customers?

It is advisable to expressly provide for the right to renegotiate prices, if necessary by adding an addendum to the original agreement. This can be achieved, for example, by a clause providing that in case future events, including any duties, cause an increase in the overall cost of the product above a certain threshold (e.g., 10 percent), the party affected by the tariffs has the right to initiate a renegotiation of the price and, in the event of a failure to agree, can withdraw from the contract.

An example of a clause might be as follows:

Import Duties Adjustment

«If any new import duties, tariffs, or similar governmental charges are imposed after the conclusion of this Contract, and such measures increase a Party’s costs exceeding X% of the agreed price of the Products, the affected Party shall have the right to request an immediate renegotiation of the price. The Parties shall engage in good faith negotiations to reach a fair adjustment of the contractual price to reflect the increased costs.

If the Parties fail to reach an agreement within [X] days from the affected Party’s request for renegotiation, the latter shall have the right to terminate this Contract with [Y] days‘ written notice to other Party, without liability for damages, except for the fulfillment of obligations already accrued.»

“This agreement is not just an economic opportunity. It is a political necessity.” In the current geopolitical context of growing protectionism and significant regional conflicts, Ursula von der Leyen’s statement says a lot.

Even though there is still a long way to go before the agreement is approved internally in each bloc and comes into force, the milestone is highly significant. It took 25 years from the start of negotiations between Mercosur and the European Union to reach a consensus text. The impacts will be considerable. Together, the blocs represent a GDP of over 22 trillion dollars, and are home to over 700 million people.

Our aim here is to highlight, in a simplified manner, the most important information about the agreement’s content and its progress, which we will update here at each stage.

What is it?

The agreement was signed as a trade treaty, with the main goal of reducing import and export tariffs, eliminating bureaucratic barriers, and facilitating trade between Mercosur countries and European Union members. Additionally, the pact includes commitments in areas such as sustainability, labor rights, technological cooperation, and environmental protection.

Mercosur (Southern Common Market) is an economic bloc created in 1991 by Brazil, Argentina, Paraguay, and Uruguay. Now, Bolivia and Chile participate as associated members, accessing some trade agreements, but not fully integrated into the common market. On the other hand, the European Union, with its 27 members (20 of which have adopted the common currency), is a broader union with greater economic and social integration compared to Mercosur.

What does the EU Mercosur agreement include?

Trade in goods:

- Reduction or elimination of tariffs on products traded between the blocs, such as meat, grains, fruits, automobiles, wines, and dairy products (the expected reduction will affect over 90% of the traded goods between the blocks).

- Easier access to European high-tech and industrialized products.

Trade in services:

- Expands access to financial services, telecommunications, transportation, and consulting for businesses in both blocs.

Movement of people:

- Provides facilities for temporary visas for qualified workers, such as technology professionals and engineers, promoting talent exchange.

- Encourages educational and cultural cooperation programs.

Sustainability and environment:

- Includes commitments to combat deforestation and meet the goals of the Paris Agreement on climate change.

- Provides penalties for violations of environmental standards.

Intellectual property and regulations:

- Protects geographical indications for European cheese, wines, and South American coffee and cachaça.

- Harmonizes regulatory standards to reduce bureaucracy and avoid technical barriers.

Labor rights:

- Commitment to decent working conditions and compliance with International Labor Organization (ILO) standards.

Which benefits to expect?

- Access to new markets: Mercosur companies will have easier access to the European market, which has more than 450 million consumers, while European products will become more competitive in South America.

- Costs reduction: The elimination or reduction of tariffs could lower the prices of products such as wines, cheese, and automobiles and boost South American exports of meat, grains, and fruits.

- Strengthened diplomatic relations: The agreement symbolizes a bridge of cooperation between two regions historically connected by cultural and economic ties.

What’s next?

The signing is only the first step. For the agreement to come into force, it must be ratified by both blocs, and the approval process is quite distinct between them, since Mercosur does not have a common Council or Parliament.

In the European Union, the ratification process involves multiple institutional steps:

- Council of the European Union: Ministers from the member states will discuss and approve the text of the agreement. This step is crucial, as each country has representation and may raise specific national concerns.

- European Parliament: After approval by the Council, the European Parliament, composed of elected deputies, votes to ratify the agreement. The debate at this stage may include environmental, social, and economic impacts.

- National Parliaments: In cases where the agreement affects shared competencies between the bloc and member states (such as environmental regulations), it must also be approved by the parliaments of each member country. This can be challenging, given that countries like France and Ireland have already expressed specific concerns about agricultural and environmental issues.

In Mercosur, the approval depends on each member country:

- National Congresses: The agreement text is submitted to the parliaments of Brazil, Argentina, Paraguay, and Uruguay. Each congress evaluates independently, and approval depends on the political majority in each country.

- Political Context: Mercosur countries have diverse political realities. In Brazil, for example, environmental issues can spark heated debates, while in Argentina, the impact on agricultural competitiveness may be the focus of discussion.

- Regional Coordination: Even after national approval, it is necessary to ensure that all Mercosur members ratify the agreement, as the bloc acts as a single negotiating entity.

Stay tuned: you will find the update here as the processes advance.

When selling health-related products, the question frequently arises as to which product category, and therefore which regulatory regime, they fall under. This question often arises when distinguishing between food supplements and medicinal products. But in other constellations, too, difficult questions of demarcation arise, which must be answered with a view to legally compliant marketing.

In a highly interesting case, the Administrative Court (Verwaltungsgericht) of Düsseldorf, Germany, recently had to classify a CBD-containing (Cannabidiol) mouth spray that was explicitly advertised by its manufacturer as a “cosmetic” and therefore not suitable for human consumption. The Ingredients of the product were labelled: « Cannabis sativa seed oil, cannabidiol from cannabis extract, tincture or resin, cannabis sativa leaf extract ».

The Product is additionally also labelled as follows: “Cosmetic oral care spray with hemp leaf extract. » The Instructions for use are: « Spray a maximum of 3 sprays a day into the mouth as desired. Spit out after 30 seconds and do not swallow. »

A spray of the Product contains 10 mg CBD. This results in a maximum daily dose of 30 mg CBD as specified by the company.

At the same time, however, it was pointed out that the “consumption” of a spray shot was harmless to health.

The mouth spray could therefore be consumed like a food, but was declared as a “cosmetic”. This is precisely where the court had to examine whether the prohibition order based on food law was lawful.

For the definition of cosmetic products Article 2 sentence 4 lit. e) Regulation (EC) No. 178/2002 refers to Directive 76/768/EEC. This was replaced by Regulation (EC) No. 1223/2009. Cosmetic products are defined in Article 2(1)(a) as follows: “‘cosmetic product’ means any substance or mixture intended to be placed in contact with the external parts of the human body (epidermis, hair system, nails, lips and external genital organs) or with the teeth and the mucous membranes of the oral cavity with a view exclusively or mainly to cleaning them, perfuming them, changing their appearance, protecting them, keeping them in good condition or correcting body odours ”.

Here too, it is not the composition of the product that is decisive, but its intended purpose, which is to be determined on the basis of objective criteria according to general public opinion based on concrete evidence.

According to the system of Regulation (EC) No. 178/2002, Article 2 sentence 1 first defines foodstuffs in general and then excludes cosmetic products under sentence 4 lit. e). According to the definition in Regulation (EC) No. 1223/2009, cosmetic products must have an exclusive or at least predominant cosmetic purpose. It can be concluded from this system that the exclusivity or predominance must be positively established. If it is not possible to determine which purpose predominates, the product is a foodstuff.

The Düsseldorf Administrative Court had to deal with this question in the aforementioned legal dispute brought by the distributor against an official prohibition order in the form of a so-called general ruling („Allgemeinverfügung“). By notice dated July 11, 2020, the competent authority issued a general ruling prohibiting the marketing of foodstuffs containing “cannabidiol (as ‘CBD isolates’ or ‘hemp extracts enriched with CBD’)” in their urban area. The company, based in this city, offered the mouth spray described above.

In a ruling dated 25.10.2024 (Courts Ref. : 26 K 2072/23), the court dismissed the company’s claim. The court’s main arguments were :

- Classification as food: the CBD spray was correctly classified as food by the authority, as it was reasonable to expect that it could be swallowed despite indications to the contrary. According to an objective perception of the market, there is a now established expectation of an average informed, attentive and reasonable consumer to the effect that CBD oils are intended as “lifestyle” products for oral ingestion, from which consumers hope for positive health effects The labelling as “cosmetic” was refuted by the objective consumer expectations and the nature of the application.

- No medicinal product status: Due to the low dosage in this case (max. 30 mg CBD per day), the product was not classified as a functional medicinal product, as there was no sufficiently proven pharmacological effect.

- Legal basis of the injunction: The prohibition of the sale of the products by the defendant was based on a general order, which was confirmed as lawful by the court.

In the ruling, the court emphasizes the objective consumer expectation and clarifies that products cannot be exempted from a different regulatory classification by the authorities or the courts solely by their labelling.

Conclusion: The decision presented underlines the considerable importance of the “correct” classification of a health product in the respective legal product category. In addition to the classic distinction between foodstuffs (food supplements) and medicinal products, comparable issues also arise with other product types. In this case in the constellation of cosmetics versus food – combined with the special legal component of the use of CBD.

Los agentes comerciales tienen una regulación específica con derechos y obligaciones que son “imperativos”: quienes firman un contrato de agencia no pueden derogarlos. Responder si un influencer puede ser un agente tiene importancia porque, de serlo, la normativa de los agentes se le aplicará.

Vamos por partes. El influencer del que vamos a hablar es la persona que con sus acciones y comentarios (blogs, cuentas en redes sociales, vídeos, eventos, o un poco de todo) habla ante sus seguidores de las ventajas de determinados productos o servicios identificados con alguna marca ajena. A cambio de esto el influencer cobra (El Real Decreto 444/2024, de 30 de abril regula los requisitos a efectos de ser considerado “influencer”. En este comentario, uso el término de forma más genérica y al margen de otras obligaciones que contiene esa norma y la Ley 13/2022 General de comunicación audiovisual).

Un agente comercial es quien promueve la contratación de productos o servicios de otros, lo hace de forma estable y a cambio cobra. También puede concluir la contratación, pero esto no es esencial.

La ley impone determinadas obligaciones y garantiza ciertos derechos a quienes firman un contrato de agencia. Si el influencer es considerado “agente”, los debería tener igualmente. Y son varios: por ejemplo, la duración, el preaviso que hay que dar para terminar el contrato, las obligaciones de las partes… Y el más relevante, el derecho del agente a cobrar una indemnización al final de la relación por la clientela que se hubiera generado. Si un influencer es un agente, también tendría este derecho.

¿Y cómo valorar si un influencer es o no un agente? Para eso deberemos analizar dos cosas: (a) el contrato (y cuidado porque hay contrato, aunque no sea escrito) y (b) cómo se han comportado las partes.

Los elementos que, en mi opinión, tienen más relevancia para concluir que un influencer es un agente, serían los siguientes:

a) que el influencer promueva la contratación de servicios o la compra de productos y lo haga de forma independiente.

El contrato indicará qué ha de hacer el influencer. Será más claro considerarlo como agente si sus comentarios animan a contratar: por ejemplo, incluyen un link a la web de fabricante, si ofrece un código descuento, si admite que se le hagan pedidos. Y que lo haga como “profesional” independiente, y no como un empleado (con horario, medios, instrucciones).

Podrá ser más complicado considerarlo agente si se limita a hablar de las bondades del producto o servicio, a aparecer en la publicidad como imagen de marca, a usar un determinado producto y hablar bien de él. Lo importante, en mi opinión, es examinar si la actividad del influencer es para que se contrate el producto que comenta, o si lo que hace es una persuasión más genérica (aparecer en publicidad, prestar su imagen a un producto, realizar demostraciones de uso), o incluso si solo busca promocionarse a sí mismo como vehículo de información general (por ejemplo, influencers que hacen comparaciones de productos sin pretender que se compren unos u otros). En el primer caso (intenta que se compre el producto) sería más fácil considerarlo “agente”, y menos en los otros ejemplos.

b) que dicha “promoción” se haga de forma continuada o estable.

Y cuidado, porque esta continuidad o estabilidad, no quiere decir que el contrato tenga que ser de duración indeterminada. Es, más bien, lo contrario a una relación esporádica. Un contrato de un año puede ser suficiente, mientras que varias intervenciones desconectadas, aun durando más tiempo, podrían no serlo.

En este caso, se excluirían como agentes aquellos influencers que realizan comentarios ocasionales, que intervienen con actuaciones aisladas, quienes se limitan a realizar comparaciones sin promover la compra de uno u otro, y aunque todo eso dé lugar a ventas, aunque sus comentarios sean frecuentes y aunque puedan tener una gran influencia en el comportamiento de sus seguidores.

c) que reciba una remuneración por su actividad

Un influencer que perciba una remuneración en función de las ventas (por ejemplo, porque promociona un código descuento, un link específico, o remite a su web para pedidos), podrá más fácilmente ser considerado como un agente. Pero también si solo percibe una cantidad fija por su promoción. Quedarían excluidos, por el contrario, aquellos influencers que no percibieran remuneración de la marca (el ejemplo de quien habla las bondades de un producto en comparación con otros, pero sin vincularlo a su promoción).

Conclusión

La frontera entre lo que cualifica al influencer como agente o no puede ser muy sutil, sobre todo porque los contratos no suelen ser unívocos y a veces sus prestaciones son múltiples. Lo más importante es analizar con cuidado el contrato y el comportamiento de las partes.

Un influencer podría ser considerado un agente comercial en la medida en que con su actividad promueva la contratación del producto (no simplemente, si lleva a cabo una labor informativa, o de imagen), que se haga de forma estable (y no meramente anecdótica o esporádica) y a cambio de una remuneración.

Lo esencial para valorar la situación concreta es analizar el contrato (si es escrito más fácil) y la forma en la que se han comportado las partes.

En resumen: para redactar un contrato con un influencer o, si ya se firmó, pero se quiere concluir, habrá que prestar atención a estos elementos. Como influencer puedes tener mucho interés en que se te considere un agente cuando concluyes tu contrato y así tener derecho a una indemnización, mientras que como empresario preferirás lo contrario.

NOTA FINAL. En España y en la fecha de este comentario (9 de junio de 2024) no conozco ninguna sentencia que trate sobre este asunto. Mi propuesta se basa en mi experiencia de más de 30 años asesorando y defendiendo en tribunales en relación con contratos de agencia. Por otra parte, y que yo sepa, hay al menos una sentencia en Roma (Italia) que aborda el asunto: Tribunale di Roma; Sezione Lavoro 4º, St. 2615 de 4 marzo 2024; R. G. n. 38445/2022

Contacta con Roberto

Car dealers can be held liable as a quasi-manufacturer for damages caused by the vehicle

11 abril 2025

- Contratos de distribución

The most dangerous mistake one can make after the announcement of the (partial) suspension of U.S. duties for 90 days is to hope that everything will go well and we will return to the pre-April 2 world.

First, because very invasive tariffs remain in place: 10 percent on all countries that trade with the U.S., including the EU, 25 percent on automotive, 25 percent on steel and aluminum, 145 percent on China.

Second, because it is impossible to predict the actions of the U.S. Administration in the short and medium term: it cannot be ruled out that tariffs will remain, increase, change targets or that other factors will intervene to turn the tide in international markets, such as an escalation of the trade war with China.

The 90-day suspension is an opportunity

The U.S.’s temporary suspension of tariffs represents a valuable window that should be used not only as a truce but also as a valuable room for action: 90 days to rehash contracts, renegotiate key clauses, and insert levers of flexibility that can protect business in various future scenarios in the U.S. and other markets.

Today’s exporters cannot afford to «sit back and see what will happen»-it is time to act, and to do so professionally and strategically. Let’s look at a checklist of important points to consider.

What do contracts with customers and suppliers entail?

The first point is to survey agreements with the trade network in the U.S. and other countries that export to the U.S., as well as with upstream suppliers in the supply chain.

Is there a written contract? The worst-case scenario – unfortunately a very frequent one – is when the parties cooperate informally, only based on orders and order confirmations. This leaves undefined not only what happens in the case of imposition of duties, but also a whole range of other points, for example, limits on damages that can be claimed in the case of breach of contract, the duration of the agreement, the applicable law, and how any disputes will be resolved.

Another very problematic scenario is one in which contracts exist, but they are generic and do not include the necessary covenants to manage the risks involved in operating in a highly litigious market such as the U.S., which, moreover, has very high legal costs.

Having done this analysis, the necessary actions can be put in place, prioritizing according to the importance of business relationships and as appropriate:

- Negotiate and conclude a written contract from scratch

- Replace the existing agreement with a complete and correct contract

- Amend and integrate the existing agreement with pacts to manage tariffs and other causes of price fluctuations

Let us dwell on the last scenario, assuming that there is a complete and correct contract but one that does not regulate price and cost fluctuation as a direct or indirect consequence of the introduction of duties.

Contract Addendum

In such cases, the correct course of action is to sign an Addendum to the original contract, specifying which covenants are being waived and which covenants are being added. It is essential that the Addendum be negotiated and signed by persons with the power of representation of the parties and that it be drafted with the help of lawyers who specialize in this field. In addition to including correct clauses, it is necessary to verify that the covenants are valid according to the rules of law applicable to the contract.

Here are some clauses that can be the subject of the Addendum, to be modulated according to the specific case and possible scenarios.

Tariff Cost Sharing

By introducing this covenant, it is provided that in the event that duties are confirmed at [x]% or are reduced or increased within certain established thresholds, the Parties will share the increase equally, or according to other established percentages.

There may also be a ceiling on tariffs beyond which a party has the right to withdraw from the contract or request the suspension of certain orders for a specified period of time, after which it has the right to withdraw.

Price Adjustment

With this covenant, a discount or an increase in the product’s price is agreed upon, as the case may be, in the case of a duty greater than [x]%.

Among the use cases, in addition to that of the company exporting to the U.S. or other intermediate markets, with final destination of the products in the U.S., is that of those who purchase a product subject to import duty and resell it, processed or assembled.

Right to Cancel or Postpone Confirmed Orders

This covenant gives the right to revoke or suspend for a certain period already negotiated orders, as such binding, in case of confirmation or introduction of duties above a certain threshold, for example, if 20% taxation was confirmed for the import of wine from the EU.

The clause can be combined with previous covenants, for example, by stipulating that below the specified threshold, the contracts remain valid, and the parties share the duty or have the right to renegotiate the price.

Supply Forecast Adjustment

With this clause the Parties can modify supply programs already agreed for a specific duration (e.g., 24 months), with continuous sales and purchase obligations at a fixed price or indexable only within certain limits. The aim is to agree on the prerequisites for reshaping supply programs in the short and medium term, which can be very useful for defining the rules that will apply to relationships with key suppliers or customers for possible changes in volumes, delivery times, and prices.

Right to Source from Alternative Suppliers

This covenant serves to be authorized, if necessary, to source alternative suppliers of components or raw materials to those previously authorized in the contract with the end customer, for example, in cases where purchasing from the original suppliers has become too costly or difficult due to duties imposed at import or in previous steps in the supply chain, or other events such as currency or price fluctuation of certain commodities beyond a certain level established in the agreement.

Hardship and Force Majeure

The imposition of duties cannot be invoked as a cause of Force Majeure or hardship, respectively, to excuse contract non-performance or to renegotiate the price, even in cases of very high price increases (such as the 145% duty imposed on Chinese products). This conclusion is almost uniform under the law and jurisprudence of the major countries involved in the tariff war: U.S., China, Canada, Mexico, France and Italy: I refer to this practical guide for a timely examination of what the various rules provide.

If the contract lacks a well drafter Force Majeure and Hardship clause, or contains a generic clause, it is important to get your hands on revising it to expressly state the cases in which a party is entitled to suspend or terminate the contract, how and when to communicate the decision to invoke the exemption, and the consequences on the parties’ contractual obligations. You can go deeper on this topic here.

Conclusion

It is essential to prepare for possible future scenarios regarding duties (confirmed, increased, changed, or decreased) and to determine the consequences on trade relations with foreign clients and suppliers: moving today, at a standstill (or nearly so), allows entrepreneurs to negotiate shared and fair solutions and to avoid, as far as possible, the emergence of tensions and conflicts with the various partners along the international supply chain.

The case: A consumer bought a Ford car in Italy from an Italian car distributor. The car was manufactured by Ford WAG in Germany and supplied by Ford Italia, which belong to the same group of companies. Following an accident in December 2001 in which the airbag failed, the consumer sued the Italian distributor as well as Ford Italia for damages. Ford Italia disputed the claims for damages asserted against it, arguing that it had not manufactured the vehicle and, because it was itself only a distributor/supplier, referred to Ford WAG in Germany as the actual manufacturer.

Question to the European Court of Justice (ECJ)

The Italian Supreme Court (Corte di Cassazione) referred the following question to the ECJ:

- the manufacturer’s liability under the Product Liability Directive 85/374/EEC is limited in accordance with Art 3 to cases where the supplier physically puts his name, trade mark, or other distinguishing feature on the product to create confusion between his identity and that of the actual manufacturer;

- or is the distributor liable as a “quasi-producer” even if he has not physically put his name or trademark on the product, but nevertheless «presents himself as its producer» within the meaning of Article 3(1) of the Directive by using the distinguishing feature in his company name, which was put on the car by another person, but leading to identity with the actual car manufacturer.

ECJ judgement (European Court of Justice) of 19/12/2024, Case C-157/23

A company that does not manufacture a product itself, but only distributes it, can still be considered a «manufacturer» within the meaning of the Product Liability Directive (85/374/EEC). This is the case if the distributor puts his name, trademark or other distinguishing feature on the product and consequently presents itself as the manufacturer. According to the ECJ, this can give the consumer the impression that the distributor is responsible for the quality and safety of the product.

However, the ECJ emphasizes that liability does not depend on whether the distributor puts the sign on the product itself. The distributor did not do so in the specific case. However, the distributor used the corresponding distinguishing feature in its company name. According to the ECJ, the decisive factor is, therefore, whether the distributor uses this name match to gain the trust of consumers and is thus perceived as a responsible manufacturer.

The distributor is jointly and severally liable with the actual manufacturer. This means that consumers can either make a claim against the manufacturer or the dealer directly. However, the dealer has the right to ask for a regress for the damage incurred from the actual manufacturer.

Remarks

The ECJ emphasizes consumer protection. In my opinion, this argument is slightly overstretched:

- According to the ECJ, the consumer should not be burdened with the complex task of identifying the actual manufacturer of a defective product.

- A distributor that sells a product and uses its name or trademark to do so creates trust in the consumer. This trust is to be protected by the liability of the authorized distributor – regardless of whether the distributor has actively put its trademark on the product or not.

- This increases the liability risk for authorized car dealers because they must obtain appropriate insurance against such a risk. In the constellation described above, authorized dealers can be exposed to unexpectedly high claims for damages under strict product liability.

Good advice is not expensive

- It is essential that such cases are legally clarified when drawing up and formulating distribution agreements with car manufacturers and that the ECJ ruling is considered.

- In addition, authorized dealers/distributors should reconsider the use of product names from the actual producer in their company name and/or in their corporate image.

The Brazilian market has not been immune to the protectionist wave of «America First.» If such measures persist over time, they could have a lasting impact on the local economy. Still, a sour lemon can often become a sweet caipirinha in the resilient and optimistic spirit that characterizes both Brazilian society and its entrepreneurs.

As is often the case in the chessboard of global economic geopolitics, a move from one player creates room for another countermove. Brazil reacted with reciprocal trade measures, signaling clearly that it would not accept a position of commercial vulnerability.

This firmer stance — almost unthinkable in earlier years — strengthened Brazil’s image in Europe as a country ready to reposition itself with greater autonomy and pragmatism, opening new doors to international markets. In a world where global value chains are being restructured and reliable trade partners are in high demand, Brazil is increasingly seen not just as a supplier of raw materials, but as a strategic partner in critical industries.

The rapprochement with Europe has been further energized by progress in the Mercosur–European Union Agreement, whose negotiations spanned decades and now seem to be gaining momentum. While the United States embraces a more isolationist commercial posture, Europe is actively diversifying its trade relations — and Brazil, by demonstrating a commitment to clear rules, economic stability, and legal certainty, emerges as a natural candidate to fill that gap.

The Direct Impact of U.S. Tariffs

The trade measures introduced under President Trump primarily affected Brazilian producers of semi-finished steel and primary aluminum, with the removal of long-standing exemptions and quotas. In 2024, Brazil exported US$ 2.2 billion in semi-finished steel to the United States, representing nearly 60% of U.S. imports in that category. In the same year, Brazilian aluminum exports to the U.S. reached US$ 796 million, accounting for 14% of the sector’s total. Losses in exports for 2025 are estimated at around US$ 1.5 billion.

Brazil’s Response and a New Phase

In April 2025, the Brazilian Congress passed a new legal framework for trade retaliation, empowering the Executive Branch to adopt countermeasures in a faster and more technically structured way. The new legislation allows, for example, the automatic imposition of retaliatory tariffs on goods from countries that adopt unilateral measures incompatible with WTO norms; the suspension of tax or customs benefits previously granted under bilateral agreements; the creation of a list of priority sectors for trade defense and diversification of export markets.

Beyond the retaliation itself, the move marked a significant shift in posture: Brazil began positioning itself as an active player in global trade governance, aligning with mid-sized economies that advocate for predictable, balanced, and rules-based trade relations.

An Opportunity for Brazil–Europe Relations

This new stage sets Brazil as a reliable supplier to European industry — not only of raw materials but also of higher-value-added goods, particularly in processed foods, bioenergy, critical minerals, pharmaceuticals, and infrastructure.

Moreover, as US–China tensions drive European companies to seek nearshoring or “friend-shoring” strategies with more predictable partners, Brazil, with its clean energy matrix, large domestic market, and relatively stable institutions, emerges as a strong alternative.

Legal Implications and Strategic Recommendations

This changing landscape brings new opportunities for companies and legal advisors involved in Brazil–Europe investment and trade relations. Particular attention should be paid to:

- Monitoring rules of origin in the Mercosur–EU agreement, especially in sectors requiring supply chain restructuring;

- Reviewing contractual and tax structures for import/export operations, including clauses addressing tariff instability or non-tariff barriers (e.g., environmental or sanitary standards), and clearly defining force majeure events;

- Reassessing distribution and agency agreements in light of the new commercial environment;

- Exploring joint ventures and technology transfer arrangements with Brazilian partners, particularly in bioeconomy, green hydrogen, and mineral processing.

From lemon to caipirinha

The world is becoming more fragmented and competitive, but also more open to realignment. What began as a protectionist blow from the United States has revealed new opportunities for transatlantic cooperation. For Brazil, Europe is no longer just a client: it is poised to become a long-term strategic partner. It is now up to lawyers and businesses on both sides of the Atlantic to turn this opportunity into lasting, mutually beneficial relationships.

On April 2, 2025, U.S. tariffs toward products from the EU will go into effect.

Given what happened with the tariffs imposed on Canada and Mexico, with a chase of announcements of entry into force and suspensions and new announcements, it is impossible to make even short-term predictions.

One must prepare oneself for the possibility of imposition of duty, which is a foreseeable and anticipated event and, as such, should be regulated in the contract. Failure to do so is likely to be very costly because there are no valid arguments for excusing the non-performance of contracts already concluded by invoking a situation of Force Majeure (which does not exist, because the performance has not become objectively impossible) or of supervening excessive onerousness or hardship: even in the case of increases well over 25 percent, tribunals around the world tend to rule out its invocation).

The caution that can be taken is to negotiate a price update clause, expressly referring, among other factors, to the eventual adoption of tariffs.

A useful clause may be the so-called Escalator or Price Adjustment Clause, by which the right to renegotiate the price is provided in the case of imposing a duty above a certain threshold, for example:

PRICE ADJUSTMENT CLAUSE

Triggering Event

A «Triggering Event» shall be deemed to occur if:

- There is an increase in customs duties or the introduction of new trade barriers not previously contemplated, resulting in an increase in the total price of the goods or services by X% or more.

- Such an increase affects either (i) the Buyer directly or (ii) the Seller due to tariffs imposed on its upstream suppliers, materially impacting the cost of performance.

Trigger Mechanism

In the event of a Triggering Event:

- The affected Party shall notify the other Party in writing within thirty (30) days of the effective date of the customs duty change or the introduction of the new trade barrier.

- The notification must include supporting documentation demonstrating the financial impact of the Triggering Event.

Renegotiation Process

Upon receipt of a valid notification, the Parties shall engage in good-faith negotiations for sixty (60) days to agree on an adjusted price that reflects the increased costs.

Failure to Reach an Agreement

If the Parties fail to reach an agreement on the price adjustment within the prescribed sixty (60) days:

Option 1 – Contract Termination: Either Party shall have the right to terminate the contract by providing written notice to the other Party, without liability for damages, except for obligations already accrued up to the termination date.

Option 2 – Third-Party Arbitrator: The Parties shall appoint an independent third-party arbitrator with expertise in international trade and pricing. The arbitrator shall determine a fair market price, which shall be binding on both Parties. The cost of the arbitrator shall be borne equally by both Parties unless otherwise agreed.

***

Another possible tool as an alternative to the clause just seen is the so-called Cost Sharing clause, for example:

COST SHARING CLAUSE

Triggering Event

A «Triggering Event» shall be deemed to occur if there is an increase in customs duties or the introduction of new trade barriers not previously contemplated, resulting in an increase in the total price of the goods by [X]% or more. Such an increase will be borne by the Buyer by up to [X]%, while higher increases will be shared equally between the seller and buyer.

***

It is appropriate for such clauses to be adapted on a case-by-case basis to best to reflect the scenarios that are expected to affect the price of the products, namely

- imposition of duty on U.S. entry

- imposition of duty on EU entry

but also indirect effects, such as where it is the seller who invokes price renegotiation, for example because the price of the product has increased due to the duty paid by one of its upstream suppliers in the supply chain, in which case it is crucial to identify which products are relevant and to document the increases resulting from the imposition of tariffs.

Duties are not paid by foreign governments (as Donald Trump repeatedly said on the electoral campaign) but by the importing companies of the country that issued the tax on the value of the imported product, i.e., in the case of the Trump administration’s recent round of tariffs, U.S. companies. Similarly, Canadian, Mexican, Chinese, and – probably – European companies will pay the import duties on U.S.-origin products levied by their respective countries as a trade retaliation measure against U.S. tariffs.

In this context, several scenarios open up, all of them problematic

- U.S. companies will pay the import taxes

- foreign companies exporting taxed products to the U.S., will see export volumes fall as a result of the price increase

- foreign companies that import products from the U.S., in turn, will pay tariffs imposed by their countries in retaliation to U.S. duties

- intermediate or end customers in markets affected by the tariffs will pay a higher price for imported products

Does the imposition of the duty constitute force majeure?

A frequent first objection of the party affected by the duty (it may be the buyer-importer or the one who resells the product after paying the duty), in such cases, is to invoke force majeure to evade the performance of the contract, which, as a result of the duty has become too onerous.

The application of the duty, however, does not fall under force majeure since we are not faced with an unforeseeable event, resulting in the objective impossibility of fulfilling the contract. The buyer/importer, in fact, can always fulfill the contract, with only the issue of price increase.

Does the imposition of the duty constitute a cause of hardship?

If a situation of excessive onerousness arises after the conclusion of the contract (hardship), the affected party has the right to demand a revision of the price or to terminate the contract.

Is this the case for tariffs? A case-by-case assessment is needed, leading to a finding of recurrence of hardship if an extraordinary and unforeseeable situation exists (in the case of the U.S. duties, which have been announced for months, it isn’t easy to support this) and the price, as a result of the application of the tariff, is manifestly excessive.

These are exceptional situations, rarely applied, and should be investigated further based on the law applicable to the contract. Generally, price fluctuations in international markets are part of business risk and do not constitute sufficient grounds for renegotiating concluded agreements, which remain binding unless the parties have included a hardship clause (discussed below).

Does the application of the tariff entail a right to renegotiate prices?

Contracts already concluded, such as orders already accepted and supply schedules with agreed prices for a certain period, are binding and must be fulfilled according to the original agreements.

In the absence of specific clauses in the contract, the party affected by the tariff is therefore obliged to comply with the previously agreed price and give fulfillment to the agreement.

The parties are free to renegotiate future contracts, e.g.

- the seller may give a discount to lessen the impact of the duty affecting the buyer-importer, or

- the buyer may agree to a price increase to compensate for a duty that the seller has paid to import a component or semi-finished product into his country, and then export the finished product

but this does not affect the validity of contracts already negotatied, which remain binding.

The situation is particularly delicate for companies in the middle of the supply chain, such as those who import raw materials or components from abroad (potentially subject to tariffs, including double duties in the case of repeated import and export) and resell the semi-finished or finished products, since they are not entitled to pass the cost on to the following link in the supply chain, unless this was expressly provided for in the contract with the customer.

What can be done in case of imposition of future duties affecting foreign suppliers or customers?

It is advisable to expressly provide for the right to renegotiate prices, if necessary by adding an addendum to the original agreement. This can be achieved, for example, by a clause providing that in case future events, including any duties, cause an increase in the overall cost of the product above a certain threshold (e.g., 10 percent), the party affected by the tariffs has the right to initiate a renegotiation of the price and, in the event of a failure to agree, can withdraw from the contract.

An example of a clause might be as follows:

Import Duties Adjustment

«If any new import duties, tariffs, or similar governmental charges are imposed after the conclusion of this Contract, and such measures increase a Party’s costs exceeding X% of the agreed price of the Products, the affected Party shall have the right to request an immediate renegotiation of the price. The Parties shall engage in good faith negotiations to reach a fair adjustment of the contractual price to reflect the increased costs.

If the Parties fail to reach an agreement within [X] days from the affected Party’s request for renegotiation, the latter shall have the right to terminate this Contract with [Y] days‘ written notice to other Party, without liability for damages, except for the fulfillment of obligations already accrued.»

“This agreement is not just an economic opportunity. It is a political necessity.” In the current geopolitical context of growing protectionism and significant regional conflicts, Ursula von der Leyen’s statement says a lot.

Even though there is still a long way to go before the agreement is approved internally in each bloc and comes into force, the milestone is highly significant. It took 25 years from the start of negotiations between Mercosur and the European Union to reach a consensus text. The impacts will be considerable. Together, the blocs represent a GDP of over 22 trillion dollars, and are home to over 700 million people.

Our aim here is to highlight, in a simplified manner, the most important information about the agreement’s content and its progress, which we will update here at each stage.

What is it?

The agreement was signed as a trade treaty, with the main goal of reducing import and export tariffs, eliminating bureaucratic barriers, and facilitating trade between Mercosur countries and European Union members. Additionally, the pact includes commitments in areas such as sustainability, labor rights, technological cooperation, and environmental protection.

Mercosur (Southern Common Market) is an economic bloc created in 1991 by Brazil, Argentina, Paraguay, and Uruguay. Now, Bolivia and Chile participate as associated members, accessing some trade agreements, but not fully integrated into the common market. On the other hand, the European Union, with its 27 members (20 of which have adopted the common currency), is a broader union with greater economic and social integration compared to Mercosur.

What does the EU Mercosur agreement include?

Trade in goods:

- Reduction or elimination of tariffs on products traded between the blocs, such as meat, grains, fruits, automobiles, wines, and dairy products (the expected reduction will affect over 90% of the traded goods between the blocks).

- Easier access to European high-tech and industrialized products.

Trade in services:

- Expands access to financial services, telecommunications, transportation, and consulting for businesses in both blocs.

Movement of people:

- Provides facilities for temporary visas for qualified workers, such as technology professionals and engineers, promoting talent exchange.

- Encourages educational and cultural cooperation programs.

Sustainability and environment:

- Includes commitments to combat deforestation and meet the goals of the Paris Agreement on climate change.

- Provides penalties for violations of environmental standards.

Intellectual property and regulations:

- Protects geographical indications for European cheese, wines, and South American coffee and cachaça.

- Harmonizes regulatory standards to reduce bureaucracy and avoid technical barriers.

Labor rights:

- Commitment to decent working conditions and compliance with International Labor Organization (ILO) standards.

Which benefits to expect?

- Access to new markets: Mercosur companies will have easier access to the European market, which has more than 450 million consumers, while European products will become more competitive in South America.

- Costs reduction: The elimination or reduction of tariffs could lower the prices of products such as wines, cheese, and automobiles and boost South American exports of meat, grains, and fruits.

- Strengthened diplomatic relations: The agreement symbolizes a bridge of cooperation between two regions historically connected by cultural and economic ties.

What’s next?

The signing is only the first step. For the agreement to come into force, it must be ratified by both blocs, and the approval process is quite distinct between them, since Mercosur does not have a common Council or Parliament.

In the European Union, the ratification process involves multiple institutional steps:

- Council of the European Union: Ministers from the member states will discuss and approve the text of the agreement. This step is crucial, as each country has representation and may raise specific national concerns.

- European Parliament: After approval by the Council, the European Parliament, composed of elected deputies, votes to ratify the agreement. The debate at this stage may include environmental, social, and economic impacts.

- National Parliaments: In cases where the agreement affects shared competencies between the bloc and member states (such as environmental regulations), it must also be approved by the parliaments of each member country. This can be challenging, given that countries like France and Ireland have already expressed specific concerns about agricultural and environmental issues.

In Mercosur, the approval depends on each member country:

- National Congresses: The agreement text is submitted to the parliaments of Brazil, Argentina, Paraguay, and Uruguay. Each congress evaluates independently, and approval depends on the political majority in each country.

- Political Context: Mercosur countries have diverse political realities. In Brazil, for example, environmental issues can spark heated debates, while in Argentina, the impact on agricultural competitiveness may be the focus of discussion.

- Regional Coordination: Even after national approval, it is necessary to ensure that all Mercosur members ratify the agreement, as the bloc acts as a single negotiating entity.

Stay tuned: you will find the update here as the processes advance.

When selling health-related products, the question frequently arises as to which product category, and therefore which regulatory regime, they fall under. This question often arises when distinguishing between food supplements and medicinal products. But in other constellations, too, difficult questions of demarcation arise, which must be answered with a view to legally compliant marketing.

In a highly interesting case, the Administrative Court (Verwaltungsgericht) of Düsseldorf, Germany, recently had to classify a CBD-containing (Cannabidiol) mouth spray that was explicitly advertised by its manufacturer as a “cosmetic” and therefore not suitable for human consumption. The Ingredients of the product were labelled: « Cannabis sativa seed oil, cannabidiol from cannabis extract, tincture or resin, cannabis sativa leaf extract ».

The Product is additionally also labelled as follows: “Cosmetic oral care spray with hemp leaf extract. » The Instructions for use are: « Spray a maximum of 3 sprays a day into the mouth as desired. Spit out after 30 seconds and do not swallow. »

A spray of the Product contains 10 mg CBD. This results in a maximum daily dose of 30 mg CBD as specified by the company.

At the same time, however, it was pointed out that the “consumption” of a spray shot was harmless to health.

The mouth spray could therefore be consumed like a food, but was declared as a “cosmetic”. This is precisely where the court had to examine whether the prohibition order based on food law was lawful.

For the definition of cosmetic products Article 2 sentence 4 lit. e) Regulation (EC) No. 178/2002 refers to Directive 76/768/EEC. This was replaced by Regulation (EC) No. 1223/2009. Cosmetic products are defined in Article 2(1)(a) as follows: “‘cosmetic product’ means any substance or mixture intended to be placed in contact with the external parts of the human body (epidermis, hair system, nails, lips and external genital organs) or with the teeth and the mucous membranes of the oral cavity with a view exclusively or mainly to cleaning them, perfuming them, changing their appearance, protecting them, keeping them in good condition or correcting body odours ”.

Here too, it is not the composition of the product that is decisive, but its intended purpose, which is to be determined on the basis of objective criteria according to general public opinion based on concrete evidence.

According to the system of Regulation (EC) No. 178/2002, Article 2 sentence 1 first defines foodstuffs in general and then excludes cosmetic products under sentence 4 lit. e). According to the definition in Regulation (EC) No. 1223/2009, cosmetic products must have an exclusive or at least predominant cosmetic purpose. It can be concluded from this system that the exclusivity or predominance must be positively established. If it is not possible to determine which purpose predominates, the product is a foodstuff.

The Düsseldorf Administrative Court had to deal with this question in the aforementioned legal dispute brought by the distributor against an official prohibition order in the form of a so-called general ruling („Allgemeinverfügung“). By notice dated July 11, 2020, the competent authority issued a general ruling prohibiting the marketing of foodstuffs containing “cannabidiol (as ‘CBD isolates’ or ‘hemp extracts enriched with CBD’)” in their urban area. The company, based in this city, offered the mouth spray described above.

In a ruling dated 25.10.2024 (Courts Ref. : 26 K 2072/23), the court dismissed the company’s claim. The court’s main arguments were :